T. Rowe Price

1307 Point Street, Baltimore, MD 21231

Ben Riley

Head of Insurance

benjamin.riley@troweprice.com, 410.345.2223

Taylor Davis

Relationship Manager

taylor.davis@troweprice.com, 410.577.2054

About T. Rowe Price

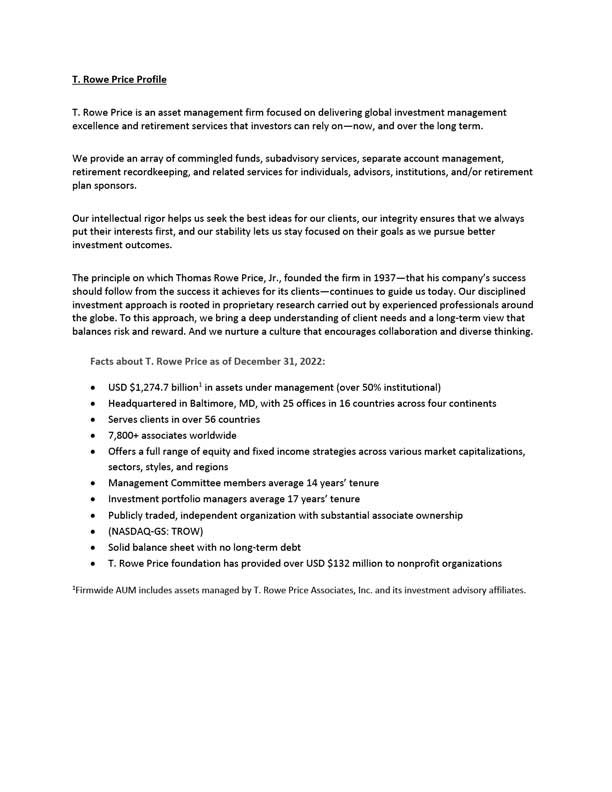

T. Rowe Price is a global asset management firm with broad investment capabilities across Equity, Fixed Income, Multi-Asset and Alternative Strategies, highly committed to excellence in service and putting client interests first. We understand that insurers have many unique considerations impacting portfolio design, and we are proud to work with many of the largest insurers in the world delivering diverse and custom solutions designed to meet those needs. Our dedicated insurance relationship managers act as an extension of your team and serve as a conduit to the T. Rowe Price organization while proactively bringing the firm’s vast resources to bear. We offer a consultative, problem-solving approach and the ability to implement solutions based on specific client objectives, constraints, and risk tolerance.

Manager Profile

Download tear sheet

Download tear sheet

02 2025

Do Not Underestimate the Impact of Quantitative Tightening

Central banks appear to intend quantitative tightening (QT) measures to run largely in the background. However, our analysis suggests that QT measures may have a much bigger economic impact than expected. This may result in banks tightening more than necessary in order to bring inflation down, potentially exacerbating recessionary dynamics.

Impact Investing in Credit: Debunking Four Common Misconceptions

Companies are being measured not only by their earnings and cash flow, but according to the effect their activities have on the environment and society. As a result, credit investors no longer judge those companies solely on their risk and return characteristics, but increasingly by their external impact as well.

The Case for a Strategic Allocation to High Yield Bonds

High yield bonds, in our view, have a key role as a strategic long-term investment and a mainstay allocation in a well diversified portfolio. Historically, high yield bonds have provided equity-like returns with less volatility.

Episode 96: Why Impact Investing Goes Beyond Green Bonds

Join host Stewart Foley on the InsuranceAUM.com Podcast as we discuss impact investing, green bonds, and public fixed income strategies tailored for insurance investors.

Finding Opportunities in Evolving Fixed Income Markets

Flexibility and a collaborative multi-sector approach, in our view, are essential components of fixed income portfolio management. We seek to combine well-diversified sector allocation with tactical insights to pursue consistent risk-adjusted returns across different market environments while capitalizing on bond market inefficiencies.

Episode 88: A Bank Loan Approach to Insurance Mandates

Join host Stewart Foley on the InsuranceAUM.com Podcast as we explore the nuances of floating-rate bank loans, high-yield credit, and the dynamics of rising rates with insights tailored to insurance investment professionals.

PODCAST

PODCAST